I’m super honored and excited to see my business alongside six other incredible startups that have embraced financial transparency, and completely opened up their financial metrics on the Baremetrics Open Startups List. I’ve written before here about why I think financial transparency is a huge asset, particularly when paired with a transparent blog or any kind of business advice. This list of open dashboards, which I’m sure will be growing rapidly soon, is a huge assets for current and aspiring entrepreneurs. It’s a ton of data and I thought it would be fun to dive deep and see what we can learn.

Introduction to the Open Startups

First I’ll do a terrible and cursory introduction to this illustrious list for background.

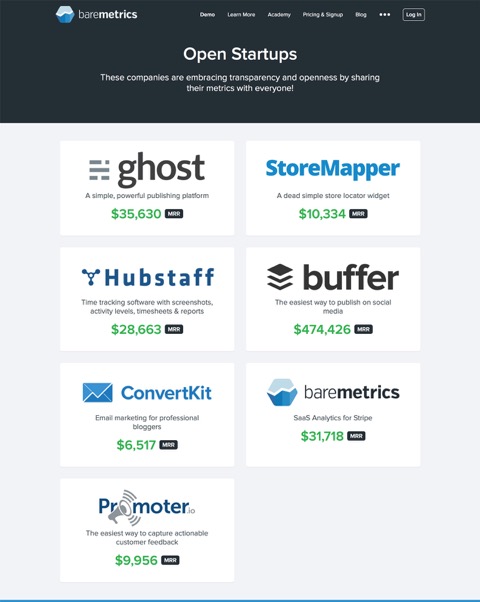

Buffer is an app for finding shareable content and queuing that content up to be shared across multiple social networks at optimal times. Founded by Joel and Leo in late 2010, Buffer has been a leader in radical transparency, publishing everything from business metrics, salaries to term sheets from their VC fundraising. Their transparency dashboard is a gold mine.

Ghost is a simple blogging platform. Launched as a Kickstarter campaign in 2013 by John O’Nolan. Ghost is an elegant Markdown-based blogging platform that I use for my blog and love. Ghost itself is completely open source software, but they sell Ghost Pro, a hosted and managed version.

Baremetrics is the ringleader behind this whole list and also a provider of one-click financial metrics for Stripe. After building a tool to visualize Stripe data for his own app, founder Josh Pigford, decided the quickest way to demo the app was to make Baremetrics’ (is that the right apostrophe move there?) metrics totally open.

Hubstaff is a time-tracking app for managing remote teams. Founded by Dave and Jared in 2012. it’s a classic “scratch your own itch” story. The founders were trying to manage a remote team of freelancers and decided to build a better tool to do it.

Convertkit is an email marketing app for authors. It was founded by Nathan Barry who is also known for writing ebooks, and then writing an even better ebook about how to write ebooks called Authority. If you’re writing an ebook (like me) you should read Nathan’s book first then use Convertkit to email about it.

Promoter is a super easy way to measure Net Promoter Score in your app and get feedback from your customers. I don’t know much about these guys. Maybe we should change that guys? Say hi sometime 🙂

Storemapper is my app and it is waay less cool than all these other ones. It started as a side project and grew into a proper micro-SaaS business. I blog about it a lot here and am writing an ebook about the process if you’re in to that kind of thing.

Phew! That took forever to write. So with intros out of the way, let’s dig in to the data.

A few quick caveats

I haven’t consulted with any of the startups on this stuff. Just me, a private citizen, digging around in the public dashboards and making some guesses. I am very likely wrong about some stuff. If any of the startups here take issue with my conclusions or want to add clarification please do so.

Also there are a crap load of links in this post. I’d recommend using open in new tab for them all so you don’t get lost.

Average revenue per user (ARPU) and Pricing strategy

Below is the most recent Average Revenue Per User (ARPU) for each startup. This figure is available right on the main dashboard for each so I won’t bother linking to it.

ARPU is an interesting metric because it’s not inherently good or bad on it’s own. Raising your prices, or the mix of your pricing options can increase ARPU but you don’t know if it’s a good change on balance until you look at how it affects signup conversions and trials. However SaaS gurus argue that SaaS startups consistently underprice their products and should look to raise ARPU in most instances.

- Promotor $97 This is really interesting to me. Promoter is by far the most aggressive on pricing with plans ranging from $49 – $499/mo. The only feature that changes by plan is you go from a limit of 500 surveys/month to 30,000/month. Businesses must really find the NPS data valuable. If I had built this product I definitely would have made the mistake of pricing it much lower than this. Lesson learned for SaaS startups to always check: http://shouldichargemore.com/

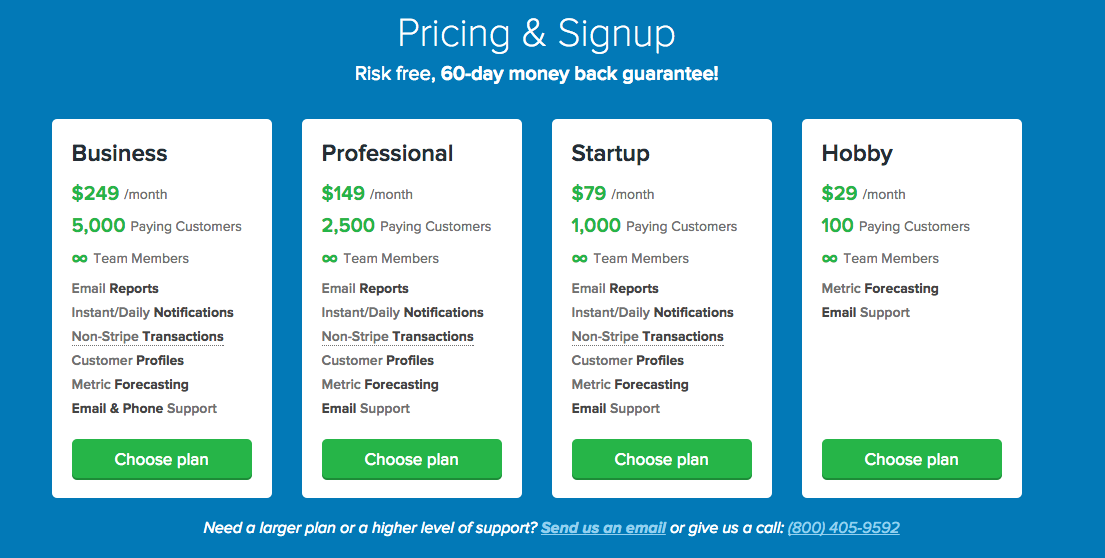

- Baremetrics $80 This one I completely get. Baremetrics gives you a ton of stuff right away that’s directly related to your bottom line and probably makes you more money. You’re probably paying an accountant or someone to do this crap already. On top of that it would be a huge pain in the ass to build it yourself. Prices range from $29 – $249/mo primarily scaling with the number of paying customers you have; no free option; requires credit card upfront.

- Convertkit $54 is also priced fairly aggressively. Particularly when customers might be switching from a free Mailchimp account. $54 is just a hair above their lowest tier at $49/mo. I would imagine that writing Authority generates a lot of first-time ebook authors, like me, who sign up for the lower tier, like me. As the app matures, one would expect a lot of their customers to progress up the plans which scale with the number of subscribers up to $359/mo @ 45,000 subscribers.

- Hubstaff $29 is still a B2B product like the previous three but is priced noticeably lower with a free option for 1 person and the highest tier at $99/mo (though it does go up further for very large teams). The ARPU is just a bit higher than the $25/mo plan for 5 person teams. The bulk of their revenue comes from plans for teams of 5-15 (more on contribution by plans later). I wonder if they might take a cue from the other startups here and consider raising prices at those plan levels.

- Storemapper $16 as I’ve chronicled on my blog, Storemapper was very much underpriced and raising ARPU has been a big priority for me. When it launched I only charged $5/mo. Over time I increased that price several times, then added Premium plans at a much higher price point and focused heavily on upgrades. For a B2B product we’re still very much on the low end. For example: We have 60% more customers than Baremetrics but on 1/3 the revenue 🙁 I think it represents a big opportunity for Storemapper though but something we’re not doing well yet.

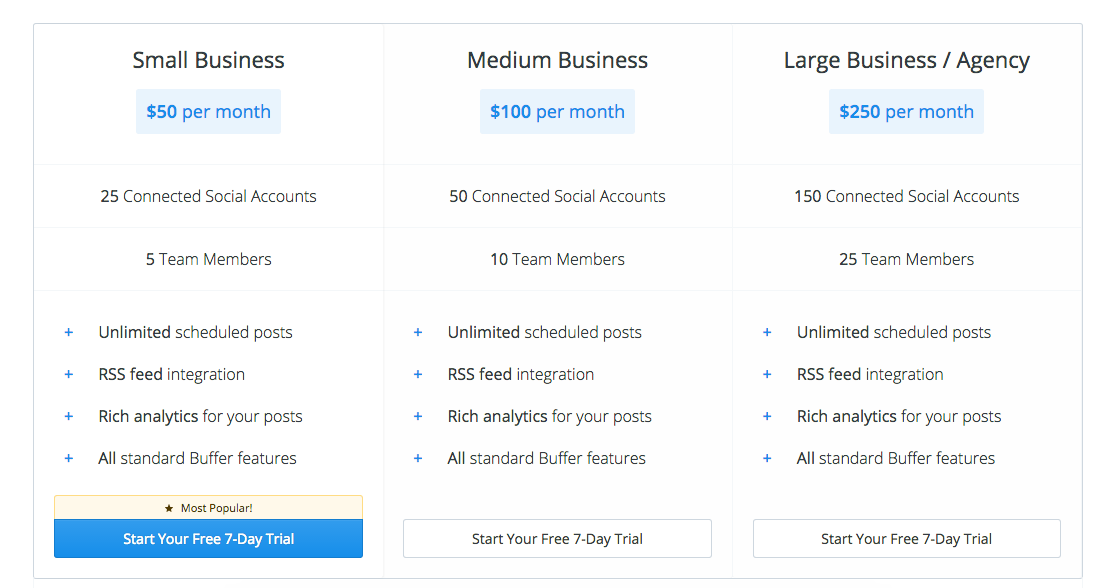

- Buffer $13 Buffer and Ghost are the only two B2C startups here so it makes sense that their ARPU would be lower. The $13 number surprised me since I know Buffer’s 1-person paid plan is $10/mo and you would expect other plans to be less than that per person. Here you can see the challenge of one-click metrics. It turns out Buffer does have group plans that range from $50-250/mo for 25-150 users. But because it’s only one charged account the ARPU figure is skewed high.

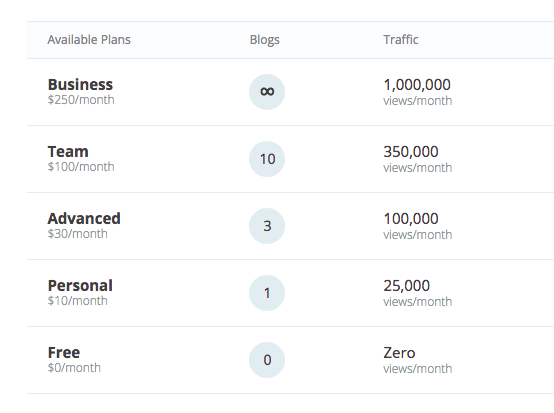

- Ghost $9 It’s interesting that’s Ghost’s current ARPU is $9, lower than their current lowest paid plan of $10/mo. They currently list plans ranging from $10-250/month allowing you to have more pageviews (Ghost’s product is a hosted instance of its open source platform) and more blogs. It’s pretty clear that the bulk up Ghost’s current paying customers (including me) are solo bloggers on the lowest tier. This makes sense as the platform is still very minimalist. As it matures it will likely appeal more to teams, companies and agencies who will opt for the higher plans. The Ghost team wrote recently about the realization that they initially weren’t charging enough and the decision to raise prices.

MRR contribution by plans, Number of plans and price discrimination

One of my favorite features on Baremetrics is the fact that for most metrics you can segment by plan to get a sense of how each plan is contributing to your key metrics. This can help you change pricing, add or retire plans that just aren’t pulling their weight.

Here are some interesting nuggets from looking into that feature. Btw, I’m not trying to pick on any of these businesses, just showing what valuable things you can learn from transparent metrics.

Almost all Buffer’s business customers are on their lowest Small Business plan of $50/mo for 5 team members. Though they have $100 and $250/mo options for bigger teams, the $50 plan (and it’s annual billing equivalent) dwarf the other two in contribution to monthly recurring revenue (MRR). Check out the table at the bottom of this page. This tells them maybe they could do a better job appealing to larger companies, or maybe that they should just increase their focus on the Awesome Plan (the 1-person $10/mo plan) and Small Business and leave the agencies to others.

Hubstaff’s sweet spot is 5 – 15 person teams. As I mentioned earlier it’s clear that the plans for teams of 5-15 people make up the lion’s share of MRR: Table at bottom. They are clearly doing well with this audience and maybe that’s a good segment to focus on increasing ARPU if they think that’s a good idea.

Promoter.io could improve the value proposition of their annual plans. Even though they offer prepaid annual pricing for all their monthly options, annual/yearly plans contribute almost nothing to their MRR: Same table. Prepaid annual plans are extremely valuable to SaaS businesses. Even though they actually decrease revenue from a customer, they massively improve cashflow which you can re-invest in the business. Prepaid annual plans have been hugely helpful for my business (and even helped me pay the rent in a pinch one time). Maybe customers are hesitant to commit to a full year, thinking they only want to test NPS intermittently. Maybe a deeper discount for annual is in order. Or maybe they just need to deploy this amazing end of year pitch email from Patrick McKenzie.. Or maybe things are just the way they like them and I don’t know what I’m talking about.

Storemapper has done way too many attempts at price segmentation. I spent a bunch of time setting up with elaborate way to A/B test prices, cookie’ing users to a plan cohort, attempting to track lifecycle differences in churn and so on. We have three plans each with monthly or annual payment options so just running one A/B test requires setting up 12 different plans in Stripe. The reality is we just didn’t have enough traffic for a test to really be conclusive. Lo and behold, the vast bulk of our revenue comes from the two plans my gut told me would work $19 and $39/mo: table. This is definitely a lesson in premature optimization. Related: I love David Kadavy on why you should run an A/A test.

Churn, the SaaS entrepreneur’s worst enemy

Next let’s look at user churn. Even with the Baremetrics data right in front of you it can still be tricky to figure out how to define and chart churn.

Below are each startup ranked by an approximate range of monthly user churn over the last 12 months.

- Storemapper 1 – 1.5% this is the category where we’re totally kicking butt. Storemapper has very low churn. The main reason is because users more or less put our app on autopilot once they set it up and get their store locator looking right whereas all these others guys are active apps that you use as part of your workflow regularly and therefore might look into alternatives more often. Chart link

- Buffer 3 – 4.5% Buffer is the most mature app by far with 10x the users/revenue of anybody else on the list. This is a great example of a target churn for a fairly mature SaaS app done well. Chart

- Hubstaff 4 – 8% had really nice 3-4% churn for a while there a year ago but it’s been on the rise. I don’t use the app directly so haven’t been following it close enough but I wonder if they raised prices around then end of 2014. So frequently in SaaS raising prices increases churn but is still a huge net win, with the remaining customers more than making up for departures. Chart

- Promoter 5.5 – 8.7% most months they are in the 5-6% range, which is great for a young SaaS business, with some occasional big spikes. The user base is comparatively quite small (104 customers) so those spikes might not mean much. Keeping churn as low as they have is all the more impressive as they are really aggressive on pricing with the highest ARPU of all the startups on the list. Chart

- Baremetrics 5.5 – 10.0% certainly has the most erratic churn rate with as low as 3% and as high as 10%. I suspect this is partly due to the fact that it’s a pretty low commitment to actually sign up. You put in your credit card, connect your Stripe account and boom you see your metrics. Folks who are just window-shopping might still want to give this a shot even if they aren’t truly a good fit. I suspect churn smoothes out if you exclude people who cancel within the first month. Chart

- Convertkit 15 – 20% has a much higher churn rate than the others. This is probably due to how crowded the email marketing space is. It’s also evidence of still being a bit pre-product-market-fit (that’s weird to type). Nathan wrote recently about how initially the product was targeting too broad an audience. After refocusing the product exclusively on authors I suspect churn will fall rapidly as it has for the last six months. Chart

- Ghost (not enough data)

Lifetime Value: the holy grail of SaaS

Customer lifetime value is the holy grail of SaaS. The reason SaaS is such a great business model is that new customers continue paying and over time generate a big predictable stream of cashflows. It’s the reason VC-backed SaaS startups can lose money for years while growing and still be worth billions.

If each new customer was forced to keep paying forever, well SaaS would be like printing money, but customer’s leave at some point. On the churn pages, Baremetrics gives you a handy “time to churn” figure which is the length of time the average new customer is expected to stick around before canceling — based on your monthly churn rate. Combining the average amount of money you expect from each new customer and the length of time you expect them to stick around gives you your lifetime value (LTV).

Now when you say, “This is my business’s lifetime value,” you need to add like 27 footnotes to that statement. Lifetime value is a tricky to calculate and assumption-riddled figure. However at least with the Open Startups List we do have LTV per customer calculated the exact same way for 7 different businesses. Fascinating.

So what do we find?

- Baremetrics $2,661 What?! They rigged the game for sure. 🙂

- Promoter $1,391 Makes sense. Aggressive high pricing while keeping churn low makes for a nice solid LTV.

- Storemapper $1,279 What, how’d we get up here? This just shows how important churn is in the end. Even though we don’t extract a lot of cash from each user, they just never leave, with a time to churn of nearly 7 years! Hence we get to hang out up here with people actually good at startups, unlike me.

- Hubstaff $388 Both Hubstaff and Convertkit have a pretty similar LTV. What’s interesting about that is they are both going after pretty established B2B markets: time-tracking and email marketing. It may be that this is good expectation if you’re going to build an app that fits many different use cases. The upside is their target market is probably much larger including smaller businesses, individual freelancers and a wider array of target customer types.

- Convertkit $359 see above

- Buffer $278 Hahaha, sucks for Buffer all the way down here. Oh wait, they’re doing $5.75 million per year in revenue. Classic difference between B2B and B2B/B2C apps. Lower LTV but a massively bigger potential market. Now that I think about it, this actually seems very high and their churn rate quite low for a product where most of their customers are individuals rather than businesses. *slow clap*

- Ghost $117 Again this makes total sense. Ghost is going after the totally massive blogging market. Nearly all their customers are currently on the lowest tier plan, but the product and company are also quite young. Despite that, they are totally crushing it with a $420k annual run rate. Hopefully so many people will read this blog post I’ll be forced to upgrade and nudge this number up.

You should join us!

Hopefully by now you’re convinced what an invaluable asset Open Startups can be for the business world. It’s a little scary, yes, but it’s also really fun. At first you going to be so scared that everybody out there is going to steal your idea or crush by knowing a little bit about your business. But after you do it you’re going to realize that world is totally not that zero-sum and that being helpful to other businesses and entrepreneurs pays itself back hugely.

If you’re already a Baremetrics customer, join us, Rip off that kimono!

If you’re not using Baremetrics… Wait you’re not? How do you know anything about your business? I can’t even.