Five years ago I built and launched the first version of a SaaS app on a single flight from San Francisco to Buenos Aires. Slowly and steadily, Storemapper grew into a healthy location-independent business for one person and then later a small dedicated remote team. At parties, I would describe it as, “not a startup; a healthy growing internet small business.” This year, almost exactly five years after launching, I sold the business for what, to someone growing up middle class in Florida, is a life-changing amount of money that will enable all kinds of exciting new projects and adventures. From start to finish, it has been an exciting ride, much of which I have documented here on the blog. With the sale concluded, I wanted to share as much as I could about the process of building a business that can be sold and how I sold it.

There’s always a risk that these posts turn into a 5,000-word humblebrag. But I really do think it’s worth a read because, unlike most business acquisition stories, which often feel like an out of the blue stroke of good luck, the way that I sold Storemapper feels very replicable for other entrepreneurs. When I spoke to someone two years ago about what it would look like if I ever sold the business I would say, “I’m not trying to sell it now, but if I ever did it would probably look this…” And six months ago I would tell a few folks privately, “I think that one of the people I met recently might be the one to buy Storemapper and if they do it will probably go like this…” And, then basically when it all went down it looked more or less like… that. There wasn’t some single huge stroke of good luck, though of course, I got lucky in the little ways that every successful business has to. An excellent outcome, but also a perfectly reasonable and achievable one that I think can serve as something of a template for other bootstrapped entrepreneurs.

This is a long and detailed post. I had so many questions going into this process and I didn’t find a ton of good posts from the founders perspective on selling bootstrapped businesses. So I thought I would just throw everything I could think of into a post and let you skip around or save it for reference when you’re considering selling your own business. Grab a pot of coffee and let’s get started.

First the obvious: why sell your software business?

The past two years of my life have been pretty amazing due in no small part to owning my own SaaS business. Two years ago, my girlfriend and I set off on a year backpacking around the world: driving the coasts of Croatia, South Africa, and New Zealand; going on safari in the Serengeti and practicing yoga in Bali; diving in Fiji and soaking up the Mediterranean lifestyle in an apartment in Barcelona. Throughout the process, thanks primarily to an awesome remote team, Storemapper was able to keep running and growing even as I took long stretches of time off the grid (hiking Mt. Kilimanjaro or rock climbing in El Potrero Chico). Last year we moved back to Washington, DC and I felt like I was living the dream: being able to afford to live in a world-class city while still maintaining complete control over my time.

I did warn you this might come out humble-braggy. But it’s important to highlight that none of the normal pressures to sell a business were present. I wasn’t burned out, on the contrary life was pretty good and running Storemapper only took about 10 hours per week of my time and attention. I wasn’t crunched for cash; Storemapper was profitable and I was saving away the bulk of the profits each month. So in light of that, why sell the business? Here was my thought process.

Running the numbers

From a purely financial perspective, owning your own stable, profitable SaaS business is incredible. Unlike the wild seasonal swings of running an e-commerce store or the feast-or-famine revenues of selling books or info-products, once you have a reasonably large SaaS customer base you tend to have predictable revenues, stable costs and a low risk of any of that changing dramatically month to month. Say the business is already profitable and in one month you add $1,000 in new monthly subscribers. You keep that $1,000. You can have a reasonable expectation that next month you will also get most of that $1,000 and so on for the foreseeable future. On top of that, the value of your SaaS business is a multiple of that number so that extra $1,000 in subscriptions may have added $36,000 or more to the total value of your business. If your business is solid and predictable and you “run the numbers” on selling this month versus six months from now you will typically arrive at the conclusion that you could keep the business, pocket the six months of extra profit and then sell the business for more than you could this month. Essentially the very positive math of operating SaaS will never lead you to conclude that you should sell your business just yet. A spreadsheet will almost always tell you to hold the SaaS and reconsider selling it in six months and it will generally be correct.

Unless of course, it all blows up somewhere in those six months.

And that’s the key consideration. When you estimate “how will my SaaS business be doing in 6-12 months” the answer is very bi-modal. There’s a very very large chance that it’s doing a bit better and a very small but non-zero chance the whole thing blows up in some unforeseen way. At least that was my estimate at the time and that’s why a key financial decision for me to sell the business was diversification.

Diversification and peace of mind

As an entrepreneur, the risks and rewards of your financial future are extremely concentrated. In my case, as Storemapper succeeded I had slowly wound down freelancing and other sources of income so that I was 100% reliant on Storemapper revenues for income. There wasn’t a lot to complain about there. Business was good and I was still saving much of what I made from Storemapper, which is more than I can say for the last paycheck I ever had. But I sat down and did a detailed visualization of what it would be like for some black swan event to force me to completely shut down Storemapper. Even though it seemed extremely unlikely I found that my loss aversion was pretty high. I’d been working on Storemapper for five years and I really wanted to lock in a solid win. One of the most important skills for a poker player is knowing when to end a big run and take chips off the table.

Leaving aside a “strategic acquisition offer” for ludicrous amounts of money (more on that later), most of the time the financial spreadsheet of selling your business doesn’t add up to a convincing case to sell. Almost everyone will end up selling for non-financial reasons like getting burned out or bored, badly needing the money or a million other reasons other than “I did the math.”

Diversification felt like one of the better reasons to sell a business.

I felt at the time that the benefits of diversification, reducing my overall risk, outweighed the opportunity cost of the potential money I could earn by continuing to run the business.

But okay, this is getting a bit boring…

Momentum for other projects

Diversification was honestly just the line of thinking that allowed me to rationalize selling Storemapper. The real driver was largely non-financial. I have often pointed out on this blog that Storemapper was a means to an end, not necessarily a passion project. I have always said that I did not want my legacy to be the King of Store Locators. Building Storemapper was a way for me to learn a ton about building and running a business and a way to achieve financial freedom. That’s not meant as an insult by the way. Crafting a great product that works well and makes customers happy can be extremely fulfilling. But I felt it was important, to be honest with myself about what my motivations were and over time, once Storemapper became financially successful, those motivations changed.

As soon as Storemapper reached a point of providing me a full-time income I began optimizing to reduce my time requirements, rather than trying to maximize revenue and growth. I started looking for another project a bit further up the hierarchy of needs. A little over a year ago I found it and started working part-time with the team at Maptia. After working with the team for nearly a year, while still running Storemapper, I knew Maptia was where I wanted to really put my focus and energy. Even though Storemapper was as close to a Four Hour Work Week business as I think is really feasible, it still takes up quite a bit of your background thought processes and mental bandwidth. I never seriously considered selling Storemapper until I had some next thing that I knew I wanted to throw myself into. I think Derek Sivers calls this the Tarzan approach of waiting until you grab hold of the next “vine” before you let go of the last one. I’m not sure I would have gone through with the deal if I didn’t have a clue what the next thing would be, but the prospect of really building momentum for projects that I wanted to invest more time and energy into was the main reason for selling the business.

That’s why earlier this year, after five years of telling people flatly “No” when they asked if I would sell Storeampper, I started to become open to the idea. Ultimately the prospect of shifting my whole focus and energy into new projects was what motivated me to close the deal.

I’m also finding that the increased bandwidth, and of course the cash, from selling the business has built momentum for other projects like this blog, angel investing, which I will probably dabble in once I formulate a real strategy for it, and a few other ideas kicking around. Having a finite chunk of money and no income, rather than an open-ended income stream, has been a surprisingly good kick in the butt to start some more ambitious projects.

So, let’s talk about the actual process

A lot of people wanted to know about the actual nuts and bolts of selling a business so here are a few FAQs. The answers are, um, a little on the dry side so if you’re not fascinated by the nitty-gritty of how to execute a sale, skip to the next section.

How did you find the buyer, or did they find you?

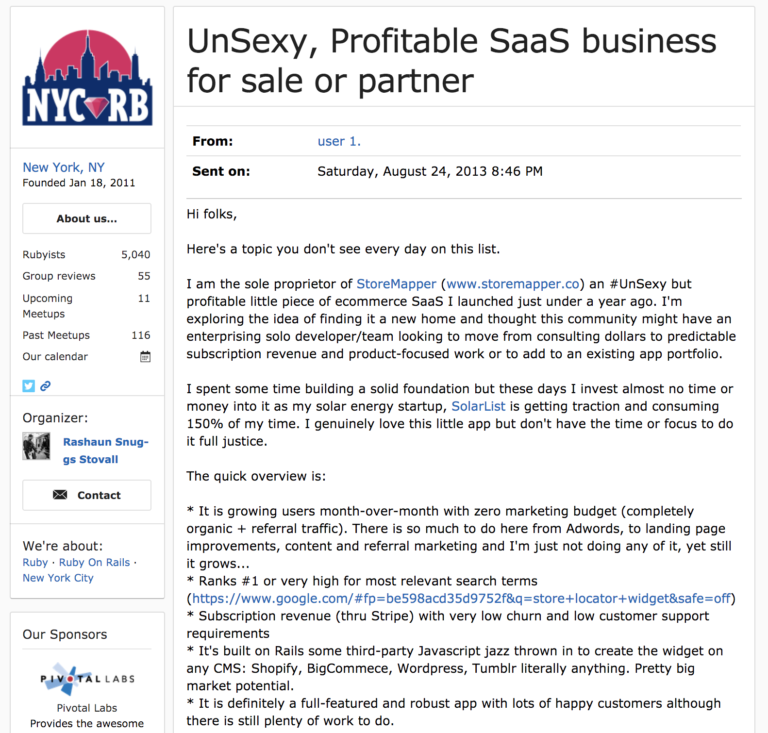

Being transparent and making the business visible by blogging, tweeting and podcasting, brought a number of potential buyers to my inbox. I would estimate at least 50-75 people have emailed me over five years. A good chunk emailed in response to a single post on the NYC Ruby Meetup group, entitled “UnSexy, Profitable SaaS business for sale or partner,” where I briefly considered selling the business about a year after it launched. I’ve been amazed at how years later that single post continued to generate random inbound interest. Initially, I took quite a number of calls, primarily out of curiosity and a huge number of those inquiries were complete wastes of time. There is a large pool of buyers out there scanning the web looking for distressed or under-valued properties trying to pick up things for a steal. If I wanted to sell Storemapper for 6x monthly profits I could have had 20 offers in a day. But most inquiries were not serious buyers willing to pay a reasonable multiple for a profitable SaaS business. A few offers during that stretch were legitimate and I almost considered selling, but then I ran the numbers and decided to keep the business. Good thing too since the business grew by more than 20x in the next four years.

I kid you not this post, by uh “user 1.”, brought in at least 30 pretty serious inquiries.

In March of this year, I went to my first MicroConf, a conference dedicated to bootstrapped software businesses, which is where I met Kevin from SureSwift Capital. In the follow-up to MicroConf I had discussions with three serious potential buyers and, somewhat by coincidence, I was connected with two more potential buyers around the same time. These were either individuals that I knew I had sold businesses before or who had raised a fund dedicated to buying businesses like mine. Serious buyers, not just someone poking around looking for something on the cheap. Over the subsequent months, I made a concerted effort to schedule calls and keep each one of the discussions moving forward at roughly the same pace. Two of the discussions pretty quickly concluded as not viable but the other three progressed to either a verbal offer or a letter of intent (more on that below) and one became the deal with SureSwift that concluded about five months after initially meeting Kevin at MicroConf.

How did the initial discussion go? What did you disclose?

While none of them lead to a deal, taking those calls from early inquiries in 2013 was helpful to me in understanding the kinds of questions a potential buyer might ask and help me to think through what I would and wouldn’t like to disclose on an initial call. Some people might play this process very close their chest, asking a potential buyer to sign an NDA and only disclosing the bare minimum information. I had already taken the path of disclosing a huge amount of Storemapper’s financial info, even going so far as to post a live public dashboard with figures like revenue growth, churn and customer lifetime value. So I didn’t really have much to hide. This simplified the process substantially. In an initial call, I was able to summarize the publicly available info and give an overview of our costs and profitability (which were not public) which is more than enough for a buyer to make an initial assessment of whether they are seriously interested and even to discuss preliminary pricing for a deal.

How did you discuss pricing?

If you ask around at conferences or find the right blog posts you’ll learn about a metric called Seller Discretionary Earnings (SDE) or Seller Discretionary Income (SDI). I first heard these terms from Thomas Smale, who runs a brokerage focusing on bootstrapped businesses like mine. Essentially it is the profitability of the business, but adding back in things like the owner’s salary and various other expenses that make sense (from a tax perspective) to charge to the business but that wouldn’t be a cost the new owner would be obliged to pay. Most discussions of pricing are framed as a combination of two components: the SDE and the multiple.

Simple example: the business has a top line revenue of $200k. After operating costs like employees, your email marketing software and other SaaS you use for the business and servers, you’re left with $90k. You add another $20k of expenses to your business like your cell phone bill, your annual Macbook Pro upgrade and so on, then you pay yourself the remaining $70k as a salary. Your SDE would be the $90k and a reasonable valuation of the business would be some multiple of that $90k.

So the default approach for discussing pricing is to agree on the business’s SDE and then haggle over the multiple. This approach seems sensible, and it probably works well if you are working with a broker with a very rigorous and well-tested methodology for what does and doesn’t count for SDE, but I really did not like it as a communication tool. The problem is that is can still be very difficult to pin down all the edges cases that affect SDE. For example, an SDE is an annual number, spanning 12 months… but which 12 months? Is it the previous (or “trailing”) 12 months? But a fast-growing business that added 50% of its customers in the last quarter and a totally flat-lined business could have the same trailing twelve months SDE, while the former would clearly be much more valuable. What if a deal takes 6 months to close, which is not uncommon, does the SDE update every month automatically or is it frozen at some point in negotiations? Why not use a forward-looking 12 months? When fellow founders ask “what’s the MRR of your business?” we are usually referring to the current level of subscriptions, but current MRR isn’t something that shows up in the historical bookkeeping; you have to calculate it across all your current subscribers. If you’re looking forward do you factor in churn? What about expected growth? Is it a 12-month forecast (what you really expect to happen) or a 12-month pro forma (current customers minus churn plus expansion MRR)? What expenses really are excluded from SDE? Does that $6,000 marketing experiment you ran 11 months ago and then abandoned count against you? Should you wait 2 months until it gets pushed out of the trailing 12 months metric? And so on, and so on…

Much like when you are pitching a client on how many “hours” a project will take, the multiple is just a polite proxy for what both parties are really thinking about: the actual amount of money being exchanged. Once I started taking the idea of selling the business very seriously I explained why I felt the “multiple” discussion was a problematic proxy and just moved to speaking in whole dollar amounts. If we close in the next X months, my price is Y. I recommend this approach.

At the end of the day, the valuation of a business is where the buyer’s willingness to pay and the seller’s willingness to sell overlap. The SDE + Multiple framing is just a way to attempt to simplify communication, but I think just speaking in whole dollar amounts is more direct and sensible.

So how does the process actually kick off?

In my case, I had a few preliminary calls with buyers. I was very transparent about the business since I already had nothing to hide. In the initial calls, we didn’t explicitly discuss a sale price, although we did allude to a range of multiples just to make sure we were on the same general page about deal size.

For my part, I was also interviewing each potential buyer about the non-monetary factors. Most importantly, what did they plan to do with the business and would there be opportunities for my team? But also making sure they seemed technically competent so that the handover wouldn’t become a giant headache. I asked a few of them for references that I could speak to from people they had worked with or other companies they had acquired. It’s a perfectly reasonable request and is immensely helpful.

Once you generally feel that this could be a serious buyer, the next step is for the buyer to prepare a letter of intent (LOI). An LOI is a legal document with no legal weight whatsoever… or at least that is my perspective, I am not a lawyer. The goal of it is for the buyer to start to put some details in writing about what they are willing to offer for the business and to lay out the terms of how you will approach due diligence. Due diligence is the process where the buyer really starts to dig into the details of the company and it will vary enormously from buyer to buyer. In the LOI you will typically describe the timeline for due diligence and the buyer may ask for a period of exclusivity, say 30-60 days, in which they will conduct due diligence and you will agree not to talk to other buyers.

You do not have to agree to exclusivity. As soon as you get an LOI from a serious buyer you can and should immediately begin looking for another buyer. Having a strong backup buyer is the absolute best way to ensure you get a good deal and have a strong negotiating position all the way to the end.

After the LOI and through due diligence you are still mostly operating on good faith. Nobody has any legal obligation to buy or sell and both parties can still walk away or radically change the deal terms. But once due diligence is over, the next step is the important one. After due diligence is when you will start preparing the final documents that are actually legally binding. In Storemapper’s case, it was an asset purchase agreement where I agreed to sell all of the operating assets to SureSwift Capital. Tax and legal considerations will determine whether the buyer wants to acquire the entire corporate entity (LLC, corporation, etc) or just the assets, but an asset sale seems to be by far the most common. So in my case after the sale, I was left still owning the empty shell of an LLC and bank accounts associated with Storemapper. Which is totally fine.

This document is the legally binding one where you want to make sure you get all the tax and legal advice you need before signing. Then you sign it.

How do you actually conclude the sale?

This is by far the most common question I’ve gotten but it has a pretty simple answer. The asset purchase agreement will more or less lay out the terms. You will use an escrow agent, a law firm or dedicated escrow firm. Both the buyer and seller sign a simple document with the escrow agent who then accepts a wire transfer from the buyer. The escrow agent then confirms to you that they have the money in their account and you start a pre-defined process of handing over control of the assets of the business. Once things like the domain, the servers, and various passwords are handed over, the buyer has a short period of time to review them and make sure you haven’t been completely misleading them. Then they give the escrow agent the thumbs up, and the escrow agent releases the money to you.

Then you have sold your business.

In our case, this process was incredibly smooth for two reasons. First, SureSwift has acquired a number of businesses already and provided a very comprehensive list of things to prepare for the day of, much of which I would not have thought of on my own. Second, at Storemapper we often use platforms rather than hand-crafting our own solutions. For example, handing over control of the app was a matter of two clicks on Heroku, but it would be a different story if Storemapper was running on some artisanal private server co-located with every other software project I’d ever started.

Did you use a broker?

In the end, I did not. I know several entrepreneurs who used brokers and recommend it highly. I have met a few brokers in this space who seem very smart and who I really considered working with. Here’s the main reason why you might not want to use a broker and why I ultimately didn’t. I was an opportunistic seller, not a motivated one.

Brokers will argue that they are totally aligned with your interest because their fee is a percentage of the deal size, so they are incentivized to get you the best deal possible. On a single deal basis that is true, but on an organizational level, a brokerage is not incentivized to get each client the absolute best possible deal they can. They are incentivized to create maximum liquidity in the marketplace. As an organization, they will earn far more if every deal takes half as long, so they do twice as many deals than if they take an unlimited amount of time and get every client a (let’s say hypothetically) 30% better offer. As a seller that 30% could be a massive difference but for the broker it’s better to just get more deals done. I’m not saying any of them would be deceptive or deny this, just that brokers are much better suited for motivated sellers who definitely want to get the business sold in a reasonable timeframe. I’ll go into this later, but my whole strategy for selling the business was to put myself in a position where I didn’t have to sell; where I would be perfectly happy to run the business myself for another year or five years if the deal wasn’t exactly what I wanted. This is not a good client for a broker and a good broker will tell you as much.

If you want a reasonable deal on a reasonable timeline, get a broker. If you want a phenomenal deal, you may still want a broker if you feel like having someone walk you through the process is worth the fee. But I did not use one.

So do you just walk away as soon as the deal closes?

No, almost all deals like this have a transition period where you are still involved with the business and slowly handover all the responsibilities to the buyer’s team. 3-6 months seems to be pretty normal. In my case, the first 30 days or so after the sale were exactly the same as the previous 30 days, where I was still managing the day to day as I had before.

How I chose SureSwift

I had never heard of SureSwift Capital until I met Kevin at MicroConf in Las Vegas, but they ended up being the ideal acquirer for Storemapper. I’ll walk through the reasons I chose them, not because I’m contractually obligated to compliment them now, but because I think the reasoning, which goes beyond just the price of the deal, is pretty broadly applicable.

- A very important feature, in some regards, simply because it’s somewhat rare in the bootstrapped or Micro-SaaS market, is that SureSwift is a long-term player. They have raised a fund to go out and acquire lots of bootstrapped profitable businesses like mine. They had closed on quite a few deals before buying Storemapper and I knew they intended to close on many more after. This means they have reputational skin in the game. Throughout the process I could talk to founders they have acquired businesses from before and I knew that if they tried to completely screw me over, then they wouldn’t be able to acquire more businesses in the future. This is a huge point of differentiation from a solo buyer, using their own money, who might only acquire one business per decade and not be that concerned about their reputation. SureSwift needs to maintain an impeccable reputation in the market or else they would not be able to deploy the capital they raised. As a first time seller there is a constant feeling of being at an informational disadvantage and having someone with long-term skin in the game really helps balance that fear.

- It was a great opportunity for the Storemapper team. A big part of Storemapper’s enterprise value was that the small and awesome team mostly ran it entirely on their own. It was important to me that after an acquisition they would have lots of opportunities and also not be pressured into making drastic changes. SureSwift offered exactly that. They manage a portfolio of software businesses and were equally happy to have the employees stay exactly in their current roles at Storemapper or to expand their roles across the portfolio. It’s hard to overstate how important those assurances have been for a smooth closing and transition.

- They had a competent team in place to accept the business. Throughout the acquisition process I also made sure to counter-interview the buyers to try to find out how well they would likely manage the handover. Were they used to working with highly remote/distributed teams? Did they have people in place who understood the tech stack we used? Even if they made a higher offer I really was not interested in selling Storemapper to an organization with a CTO who only codes in .NET and who wants to get everybody on the phone every other day for a two hour check-in.

- Lastly, they had similar priorities on what was and wasn’t important in the transaction. A classic move from a potential buyer, that I’ve experienced in other businesses, is to make all kinds of assurances about how interested they are very early on in the discussion and then at the very end of the deal process the lawyers and accountants dig in with a million nit-picky irrelevant quibbles; then they come back with a ridiculous low ball offer. This was not how SureSwift operated. I more or less asked this point blank and then verified by speaking to other founders that had been through the process with them, that they really did focus on the key important metrics and didn’t sweat the small stuff.

What made Storemapper sell-able

Kevin from SureSwift is probably better equipped to answer precisely why it made sense for them to buy Storemapper, but I think it’s worth my taking a stab at why I think it was a sell-able business.

There are many things that are required, being necessary but not sufficient, of a sell-able business but only one thing makes a buyer want to buy your business: they need to see an opportunity. Entrepreneurs sometimes adopt a strange language when discussing acquisitions that seems to assume that acquirers are just out there as a natural part of the world, and if they create a “good business” someone should want to buy it. But acquirers of all kinds are not simply walking around looking to pay full market price to take over good businesses. They need to see an opportunity. Either they need to feel they are getting a good deal on the business by paying below what it’s worth, or they need to see a pathway to the business performing much better under their ownership. The first one, deal hunters or vultures, are by far the dominant mentality of potential acquirers because it’s the easiest and simplest way to make sure an acquisition is a good investment. As a potential seller you want to sniff out quickly if someone is just poking around looking for distressed assets and move. The best reason for a business to be sell-able is for the buyer to see an opportunity for the business to flourish under their ownership and be a worthwhile investment even when paying full market value for the business; a true win-win. Here are a few examples of good reasons for a buyer to want to buy your business:

- Budget dynamics: there is a well known budget dynamic in large SaaS businesses that they often lose money when they grow quickly. If you spend $50 to get a customer for your $40 ebook, you’re doing it wrong. But it’s perfectly rational to spend $50 to acquire a customer who subscribes to your $10/month SaaS plan, who then stays paying for 24 months. But in this case you actually lose money in the short-term, the faster you grow the faster you rack up losses even when your business is doing great. A small bootstrapped startup might not have the budget to sustain this but a well-funded acquirer might be perfectly happy to plow money into customer acquisition, growing the enterprise value of the business quickly, even if it means short-term losses.

- Customer synergies: an acquirer may have a product that is complementary to an overlapping customer base. They may be able to cross-sell their product to your customers and vice versa, reducing their customer acquisition costs and creating up-sell opportunities. Cross-selling and up-selling are immensely more efficient than finding completely new customers so an acquirer may see buying your business as a far more effective use of funds than burning through the same money on marketing.

- Cost synergies: less fun than the others but still common. An acquirer may have a team or overhead that allows them to run your product for much less than you currently do. This doesn’t always have to be the “chop shop” strategy where they would fire some of your employees to cut costs. For example Storemapper never got very involved in paid Facebook or Adwords ads primarily because we just weren’t big enough to justify having a full time person dedicated to managing it. A larger acquirer might be able to amortize the cost of a smart marketer across a larger business.

- Core competencies: businesses as they grow often require different core competencies. A very early stage business needs to be able to connect deeply with customers’ needs and iterate quickly to achieve product-market fit. A more mature business may no longer need to iterate quickly but rather scale up its existing activities. These can be completely different skillsets that different owners excel at, which can make a business sell-able under the right circumstances.

Any one of these, or hopefully several plus others I haven’t mentioned, creates the seed of an opportunity to buy/sell a business. However there are a many other factors that, in combination with an opportunity, make a business sell-able. Ultimately it is the buyers’ opinions on these that matter, but here is my take on the key factors to making your business sell-able.

An awesome team: first and foremost is building a team that can keep the business growing without you. Too often founders want to insinuate themselves into every part of the business, making the entire structure dependent on their engaged focus. Instead you want to build a team and a product that are self-sufficient without you. A buyer can’t possibly learn exactly how active you are day-to-day before a sale, so a great team gives them confidence that the whole thing won’t collapse after you walk away.

Predictable, diversified revenue base: the reason for being of a business is to generate revenue but not all revenue is created equal when it comes to buying and selling a business. A buyer is buying your revenue streams and different revenue streams have different degrees of risk to a buyer. Obviously customers with recurring subscriptions are more valuable than one-off purchasers. But also customers that have been paying for 30 months continuously are more valuable than a customer who subscribed last month. A customer base made up of a diverse group of “boring” businesses is better than a customer base composed entirely of fidget spinner manufacturers. $10,000 per month composed of 1,000 companies paying $10 is more robust than two companies paying $5,000. The more predictable and diversified the revenue base, the more sell-able the business.

Documentation and processes: basically a business needs to have its shit together to be sell-able. Buyers can to some extent be choosy and they can and should pass on buying a great business that will be a nightmare to run. Having thorough documentation and good internal processes may not really increase the value of your business per se, but not having them can be a deal-breaker to an acquirer. You want them to be impressed by how painless it will be to take over operating the business.

This is an incomplete list but I believe some combination of all of these factors lead to Storemapper being a very sell-able business. It had an awesome team who had mostly been with the company for more than two years and who managed the day to day business without me having to be involved. The examples of me going completely offline for 10 days in Tanzania and Fiji really drove this home. It had great documentation and processes and a solid predictable, customer base with recurring low-churn revenue. It was also very easy to see how a buyer with different skillsets could invest time, money or even just more focus to really increase the already growing revenue.

Lessons on how to sell a bootstrapped SaaS business

The book Built to Sell is an essential read for every entrepreneur. It lays out clearly and simply some of the key counter-intuitive features of selling a business versus running a business. Here are some of the most salient lessons from that book and elsewhere.

Run your business to sell it, before you want to sell it

I can’t emphasize this enough. If you think you will ever want to sell your business, the time to start preparing is now. Don’t wait until you are actually ready to sell it. Making a business sell-able requires systematically making small or big decisions differently and optimizing for certain qualities in your business that can’t be bolted on last minute or even over the course of a few months. Your business will be sold on a track record, every selling point about your business will be greatly enhanced by being able to point to 48 consecutive months of that same thing. Through some combination of books and blog posts I was fortunate enough to internalize this lesson early on and acted accordingly. It turns out that creating a sell-able business is also very similar to running a lifestyle business, focusing on taking yourself out of the day to day and optimizing to recapture your time and freedom. The process of removing yourself from a business is also a big part of making that business sell-able.

Focus on financial, not strategic acquirers

First let’s differentiate between the two broad categories of potential buyers of a business: strategic and financial acquirers. A strategic acquisition is the kind you hear most about in the news: Facebook buying Instagram, Google buying Nest. Strategic acquisitions can be driven by a variety of motivations such as buying a competitor before they grow too large or a proprietary piece of intellectual property. The reasons can be varied but the common thread is that the actual finances of the business are a secondary concern. In a strategic acquisition, businesses can be purchased for many times their actual value. Though they dominate the news, these kinds of acquisitions are comparatively rare. Far more common is a financial acquisition where someone wants to buy the business and then earn a good return on their investment through the future profits of the business.

That’s the definitional difference but here is the key difference between the two kinds of acquisitions: a strategic acquisition is mostly about getting lucky whereas a financial acquisition can be engineered by a founder. In both instances you have to run a great company, but beyond that there isn’t much you can do to increase your odds of a bolt from the blue strategic acquisition offer for 25x times your revenue. But you can structure your business in such a way that it is highly attractive to financial acquirers and greatly increase your odds of a successful transaction. Learn what makes a successful financial acquisition from this post and elsewhere. Get a sense of what the very high end of a financial acquisition might look like and shoot for that.

Acquisition offers are a hidden benefit of radical transparency

I joined the radical transparency train after being inspired by, and learning a ton from the founders of Buffer, Baremetrics, Keen, Patrick McKenzie and many more. I felt at the time that being transparent even with the financial metrics of the business added an appropriate level of credibility and was helpful to readers. Over time, as copy cat apps started popping up, I began to question whether being so transparent was really a good idea, although they never made a material dent in the business. However being public about the numbers behind Storemapper certainly increased the number of acquisition inquiries I received over the years. People knew the revenue and growth and could immediately tell whether Storemapper was roughly in the range of businesses they were looking for. Between that and reading my transparent blogging about the strategy and challenges, we only needed to briefly discuss the costs and profitability before they would have enough information to credibly make an initial offer. This hugely accelerated the speed at which I could have acquisition discussions. Having multiple buyers involved at the same time really helped me feel confident to press forward with the deal. In the end transparency definitely was a big net benefit.

Go to conferences

This one is pretty self-explanatory but despite all the blogging and sporadic inbound interest in Storemapper, I only reached a critical mass of serious acquisition offers after attending my first Micro-Conf in Las Vegas.

How to get the best deal possible

Obviously I have only sold one business, so this isn’t some proven methodology for selling businesses that I’ve honed over years. But, I’m synthesizing advise I got from other founders and that I felt generally worked well for me.

Be an opportunistic seller

The absolute most important factor in getting a great deal in a sale is not having to sell. All of the work here happens well before the sale. Craft your business in a way that you would be perfectly happy to run it indefinitely. Get your work/life balance in order and your stress level under control. Go into a sale process with the idea that if you don’t get exactly the offer you want, you are 100% willing to just wait it out and run your business for another year. Running yourself into the ground, getting burned out or bored of your business, or falling into a cash crunch, or any other situation where you really need to sell the business is an excellent way to get lured into accepting a low-ball offer.

Be aggressive and ready to walk

Not having to sell allows you adopt an aggressive ‘take it or leave it’ attitude to a sale negotiation. You want to be extremely polite, nobody wants to buy a business from a jerk, but continually remind the buyer, “look if we’re not on the same page here, no big deal, let’s just save each other some time and move on.” Smart buyers can sense if you are a really motivated seller and can use all kinds of tactics, waiting until the last minute of negotiations when you have already invested a lot of time and energy into the deal, to try to gain last minute leverage. The sale process can be long and grueling. With every hour you spend working on a deal, your brain starts to become more and more committed to getting the deal done. You start envisioning your life post-sale before it closes. But, that is a sunk cost fallacy. Throughout the process I repeatedly made myself sit down and visualize the process of walking away from the whole deal if necessary and that gave me the confidence to stand my ground, from actually turning down a pretty big offer to holding firm on several small points, to get the best deal I think was reasonably possible.

Have multiple offers in parallel

Being aggressive and ready to walk away from one particular negotiation is made immensely easier if you have multiple offers on the table. It’s important to make an effort to develop those offers at roughly the same time. From the time you meet a buyer to the time you have a firm offer may be many months. When you’re in late-stage negotiations, having another firm vaguely interested in talking about an acquisition is not nearly as useful as having three LOIs in the same week. You can view each thread with a buyer as a conversion funnel and try to keep as many conversations moving forward in parallel.

Purposefully under-optimize

The first few recommendation are all about the seller’s mindset, but it’s important not to neglect the buyer’s psychology. One thing I would recommend is to purposefully under-optimize certain aspects of your business. A business that is fully optimized in every aspect, with the juice wrung out of every possible avenue of improvement, is not actually attractive to a buyer. They want to see areas where they can come in and bring their own skills and resources to quickly accelerate the business. For example, I really do not understand paid search advertising (Google Adwords, Facebook, etc) so I purposefully put almost no effort into it as a customer acquisition channel for Storemapper. I would highlight that fact to buyers saying, “Despite the fact that revenue is growing well, I have put almost no effort in paid ads, if you have an Adwords guru on staff, I’m sure they can fire up a profitable paid advertising funnel in no time to further increase growth.”

Build a narrative for the buyer

At the end of the day buyers need to tell themselves a story about acquiring your business. If they have raised outside funding and have partners or a board, they need to be able to tell that story to defend their investment to their partners. If they are a solo buyer they still need to tell that story to their spouse or to themselves. Almost everything in this post was part of an explicit narrative that I built and gave to potential buyers. For me it looked something like this:

“I’ve been running this business for five years. It’s profitable, growing and has product-market fit. I have a great team who handle most of the day to day operations so I’m perfectly willing to run it indefinitely. However, because I’ve run this with a lifestyle business approach, certain aspects are very under-optimized and its still performing well below its full potential. The right buyer, who I, and more importantly my team, would like working with, could pay a comparatively high price for the business and still generate a very strong return on investment.”

Build your own narrative and sell that story to the buyer.

Conclusion

Wow, thanks for hanging in there all the way to the end. If you have any follow-up questions, fire them at me on Twitter or join the discussion on IndieHackers. If you are little earlier on in the Micro-SaaS process, feel free to check out my ebook Building Micro-SaaS Businesses.

Building Micro-SaaS Businesses

All the stuff I did wrong building a six figure Micro-SaaS business and how to do it better yourself. Anecdotes, pseudo-philosophy and self-deprecation.